Why filing 2290 online is the smartest choice for today’s truck drivers

Why filing 2290 online is the smartest choice for today’s truck drivers

Blog Article

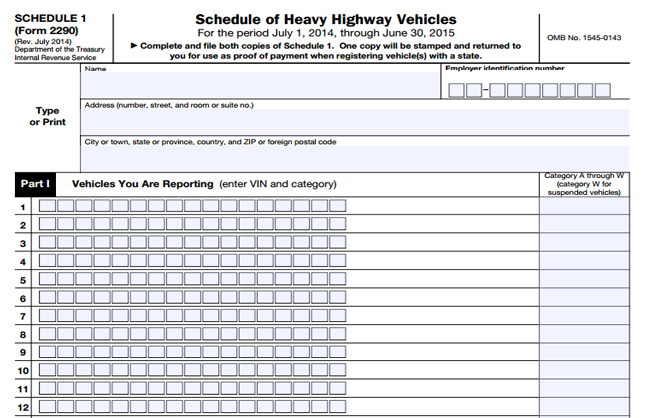

The IRS is always working to help improve the way taxes are filed and submitted. More and more people are choosing E-file to submit their taxes to the IRS. After an overwhelming response to E-filing in 2008 the IRS decided to improve this method of filing for 2010. Most of the accountant and CPA in New York and other cities have found it an easier way of filing taxes as it saves time.

Before I knew it, I was making a speech to the entire country. It was obviously not written, but spoken from my mind, my heart and my soul. It all made perfect sense to me and covered all 2290 tax form the important topics that are plaguing our country and its people. I will recount it here. Perhaps it will reach the eyes and ears of someone who will be able to hear it.

A major concern many people have is that they worry about their tax return disappearing Form 2290 online into the black hole of cyber-space never to been seen or heard from again until they receive a threatening letter from the IRS informing them that they have not filed a return. There is no need for fear, usually within 24 hours and almost never more then 48 hours the IRS sends a message to the transmitter (your accountant) either accepting the return or telling them that there are errors which must be corrected. In either case the process is transparent and foolproof ensuring that every return is accounted for.

The provision of section 234A and 234B or levy of interest shall be applicable. The penalty for concealment can be escaped if disclosure is made in the statement during search for the years for which the due date for filing return of income has not expired in respect of search initiated before 01.06.2007. When source of income declared u/s 132(4) is not questioned in the statement, the immunity cannot be denied on the ground that assessee did not indicate the source of deriving undisclosed income. (CIT v. Radha Krishan (278 ITR 454) (All).

When you do finally end up filing your return - sometime before October 15 - the IRS will make up the difference between your actual tax liability and what you paid as your estimated tax liability. If you didn't pay enough originally, you will have to make an additional payment to the IRS heavy vehicle tax. But if you paid too much you can look forward to a refund.

The tax account transcript is the best of the two because it will include any adjustments that were made after you filed. The type of information included are your adjusted gross income, taxable income, your marital status and whether you filed a long or short form 1040.

Missing your 2007 federal income tax isn't a huge disaster. In fact, it's never been easier to fix it thanks to many small businesses that specialize in helping Truck tax taxpayers through exactly this kind of problem. The sooner you file, the sooner you'll see.